2021 is what I call my money saving year. I still have item or travel (if finally allowed) goals for the year that I will achieve, but I need to filter more my daily expenses, which frankly needs an assessment, and improve more my money habits.

Here are some actionable steps that I will take this 2021 in order to save more money because if there's one very important life lesson I've learned last year, it's the importance of having a trust fund/savings that's worth 6 months to 1 year of living expenses!

Photo Credit: Pinterest.com

1. LET GO OF UNNECESSARY EXPENSES

- I did an audit of my daily expenses and learned that a lot of my unnecessary expenses are spent on food and vices. Man, I love eating and I love eating good food; I can eat in restaurants all day, but as Hippocrates said: "Everything in excess is opposed to nature". Restaurants charge more than three times of the usual price of food ingredients and my daily restaurant habit could result to my money leaving my bank account three times faster.

To motivate myself to continue with my journey and to finally part ways with my excessive food habits and vices, I decided to save and use the money that I will usually spend on these to buy my birthday or Christmas gift this year. Pray for me!

2. ALWAYS KEEP AN EYE ON AND WAIT FOR SALES

- One thing I've learned over years and years of shopping experience is everything goes on sale. However, I can get pretty impatient and would always end up buying the stuff right away.

If I could just be a little more patient, I would be able to get the same items at a more affordable price.

At the moment, I'm looking at cookers for my mom for her birthday. Lately, she's been into cooking and my brother's running his home- based food business too named

House of Hungry, and I figured they might need a new gas range soon because the one they're using is our first- ever gas range and I believe it's about 10 years old already. I'm looking at Beko's cookers and gas range collection at the moment as my appliance of choice.

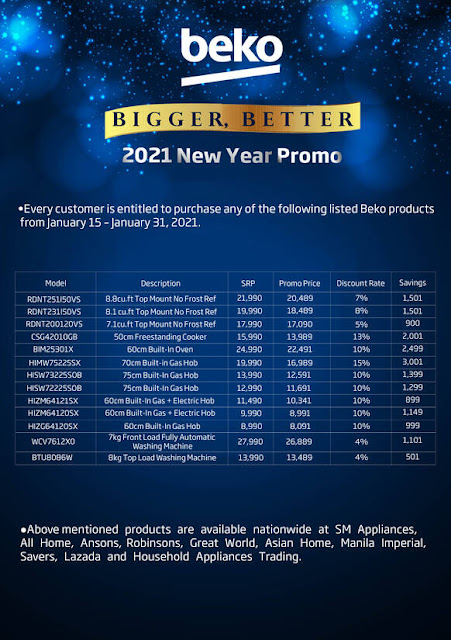

And speaking of sale, THEY ARE ON A SALE! Is this a sign!??! Maybe I should buy my mom an advanced gift!

It's the new year and we all need a fresh start; if you want to replace an appliance or if you want to finally start the online food business, now's the best time to buy appliance from Beko because they're holding the Bigger Better Appliance Sale that runs from Jan 15-31, 2021. Up to 15% off on selected appliances ranging from cookers, refrigerators, and washing machines!

3. KEEP A RECORD OF MY INCOME AND EXPENSES

- Believe it or not, I just started tracking my expenses two years ago. Yeah, I aged late LOL. Imagine if I did this earlier, I would have had a better grasp of my earnings and expenses early on, thus I would have saved so much more.

When you don't keep track of your income, it's hard to move forward and start planning for your future and similarly, if you don't have a grasp of what your daily/weekly/monthly spending is like, you unknowingly derail your future plans and worse, risk yourself to bankruptcy. Like what entrepreneurs would say: "If you don't know your money, you don't know your business."

You gotta build a close relationship with your money; you worked hard for it and you definitely should know what's happening to it every cent of the way (like that pun lol). Appreciate how you earn it, learn how to spend it. Tracking is a good way to start appreciating and being wise with money.

I've seen money spreadsheets and trackers that are way too complicated, it makes me not want to do it anymore. Let's simplify, most especially if it's your first time. Microsoft Excel actually has a nice tracker template that's simple and fairly easy to understand and fill in. The formulas have been pre-entered already for instant computation and all you have to do is just enter values.

I've also made my own Income and Expense tracker. This one features a savings allocation where you get to choose where you want to put your savings or excess funds. The savings allocation column is where you can divide the percentage of your income that you want to save before allocating for or after expenses.

Photo Credit: Pinterest

4. START A MONEY CHALLENGE

- You know, this money challenge thing (aka modern Paluwagan) is actually a really good way to force yourself to save.

I recently started cutting down on unnecessary expenses and at the same time, challenging myself to save the amount I'd spend on those and see how much I will come up at the end of the year so it's like a blend of tips 1 and 4.

Photo Credit: vietnaminsider.vn

5. RESIST ONLINE SHOPPING

- To be fair, my online shopping habit isn't so bad and I'm proud of this because impulsive shopping is a habit I have triumphed over with the last few years. However, there were some online purchases I have made last year that were either meh or can-live-without so I vow to be more mindful of my online purchases this year. Heck, I should stay out of it often!

Now that's all for the money saving strategies that I strive to follow and live by this year. I hope you are doing great with whatever goals you have for the year.

Share with me what your money saving strategies are in the comments section!

1 Comments

Im in my mid 20s and its just recently that I learn about income and expense tracker. I use a detailed excel sheet provided for free by Thea Bautista. I also watch a lof of Financial diet videos during quarantine!

ReplyDeleteLet me know what you think of this post! :)